Corporate Governance Operation - Stark Technology Inc.

Continuing Education for Corporate Governance Officer

Operations of Corporate Governance

| Evaluation Item | Implementation Status | Differences with the Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies and reasons | ||||

| Yes | No | Summary description | ||||

| I. Does the Company stipulate and disclose the corporate governance best practice principles in accordance with the “Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies”? | V | The Company has already established the corporate governance best practice principles in accordance with the “Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies” and has disclosed them on the MOPS and company website. | No significant differences. | |||

| II. The shareholding structure of the Company and shareholders' rights and interests | ||||||

| (I) Does the Company have Internal Operation Procedures for handling shareholders’ suggestions, concerns, disputes and litigation matters. If yes, have these procedures been implemented accordingly? | V | (I) The Company has already appointed a spokesperson and acting spokesperson unit to handle shareholders’ suggestions or disputes. | No significant differences. | |||

| (II) Does the Company possess a list of major shareholders and ultimate controllers of these major shareholders? | V | (II) The Company gets hold of these information on its directors, managerial officers and major shareholders with more than 10% stakes at all times and files the shareholding of its major shareholders in a timely manner. | No significant differences. | |||

| (III) Has the Company built and implemented risk control and firewall mechanism with the related companies? | V | (III) The finance and business of the Company and its affiliates are separate and independent operations. | No significant differences. | |||

| (IV) Has the Company established internal rules prohibiting insider trading on undisclosed information? | V | (IV) The Company has established the "Procedures for Handling Material Inside Information" and the "Key Points of Prevention of Insider Trading" to prohibit insiders from trading securities using unpublished market information. It also stipulates that directors and managers shall not trade the Company's shares or other equity securities during the period of 30 days before the date of announcement of the annual financial report or during the period of 15 days before the date of announcement of the quarterly financial report. The Company notifies directors and managers by email before the closed period of each quarter to prevent them from violating the regulations accidentally. | No significant differences. | |||

| III. Composition and responsibilities of the Board of Directors | ||||||

| (I) Has the Board of Directors established a diversity policy, set goals, and implemented them accordingly? | V | (I) The Company has formulated a diversity policy as per the "Corporate Governance Best Practice Principles" to strengthen the functions of the Board of Directors. The nomination and election of the Company's board members are in accordance with the Company's Articles of Incorporation, and a candidate nomination system is adopted. In addition to evaluating the educational and career background qualifications of each candidate, the Company follows the procedures for the election of directors and the Corporate Governance Best Practice Principles to ensure the diversity and independence of the board members. Please refer to pages 32~33 of this annual report for information on the Company's implementation of its diversity policy. |

No significant differences. | |||

| (II) Does the Company have plans to appoint other functional committees on a voluntary basis other than the appointment of the Remuneration Committee and Audit Committee which are required by law? | V | (II) The Board of Directors of the Company has approved the appointment of the following committees and the establishment of their charters. They are the “Remuneration Committee”, “Audit Committee”, “Sustainable Development Committee”and “Risk Management Committee” and stipulated the “Remuneration Committee Charter”, “Audit Committee Charter”, “Sustainable Development Committee Charter” and "Risk Management Committee Charter". Their term and appointment is the same to that of the Board of Directors. Please refer to page 61~64 of this annual report, (VII) “The composition, responsibilities, and operations of the Remuneration Committee”, pages 45~48, (III) “Operation of Audit Committee “, pages 64~66, (VIII) “The composition, responsibilities, and operations of the Sustainable Development Committee”, pages 66~68, (IX) The composition, responsibilities, and operations of the Risk Management Committee, and the Company's website: https://www.sti.com.tw/. | No significant differences. | |||

| (III) Does the Company stipulate performance assessment Board of Directors Performance Evaluation Method and conduct the performance assessment on a yearly basis, and was the result of performance assessment reported to the board of directors as a reference for individual directors' salary and nomination of reappointment? | V | (III) The Company's Board of Directors passed the “Regulations Governing the Board of Directors and Functional Committees Performance Evaluation” to conduct annual self-performance evaluations of the Board of Directors, individual board members, and functional committees (including the Audit Committee, Remuneration Committee, Sustainable Development Committee, and Risk Management Committee). Please refer to page 44~45 of this annual report for the 2024 evaluation results of the Company's Board of Directors, individual board members, and functional committees. The performance evaluation results were reported to the Board of Directors on February 27, 2025. In 2025, the Company will continue to enhance communication with directors to improve meeting quality. | No significant differences. | |||

| (IV) Does the Company regularly evaluate its external auditors’ independence? | V | (IV) The Audit Committee assesses the independence and suitability of its assigned CPAs regularly every year. In addition to obtaining the Declaration of Independence and the AQIs provided by the CPAs, the Committee makes evaluation using the assessment items in the following table to confirm that the standards are not violated and refer to AQI’s 13 indicators. According to the Company's evaluation on several indicators, the firm's ratio of professional support to the audit department is higher than that of its peers, and the ratio of communication from the competent authority on defects is 0%. The Company will continue to strengthen internal quality review procedures and promote digital auditing to improve audit quality. The evaluation results of the most recent year were discussed and approved by the Audit Committee on February 27, 2025 and were submitted for the resolution of the Board of Directors passed on February 27, 2025 on the independence and suitability evaluation of the CPAs. | No significant differences. | |||

| Item | Yes | No | ||||

| 1. Obtained the Statement of Independence issued by the CPAs. | V | |||||

| 2. The latest independent audit service has not passed the seventh year and there must be a two year interval before returning to provide the service. | V | |||||

| 3. The CPA has not served as a director, supervisor, managerial officer of the company or subsidiaries or has held positions with significant influences to the audit work. | V | |||||

| 4. The CPA is not a spouse or relative within the second degree of kinship with the directors. | V | |||||

| 5. The CPA does not hold any shares of the Company or the subsidiaries. | V | |||||

| 6. The CPA does not have direct or indirect material financial interests relationship with the Company. | V | |||||

| 7. The CPA must not be in a relationship of joint investments or profit sharing with the Company. | V | |||||

| 8. There are no loans between the CPA and the company. | V | |||||

| 9. The CPA is not doing regular work concurrently for the Company or affiliates receiving fixed salaries. | V | |||||

| 10. The CPA has not defend the Company in legal actions or negotiate the conflicts with any third party on behalf of the Company. | V | |||||

| 11.The CPA is not involved in the management duties in strategic decisions of the Company or affiliates. | V | |||||

| IV. Does the listed company have qualified and sufficient corporate governance personnel, and does the company have a corporate governance officer to be responsible for matters regarding corporate governance (including but not limited to providing Directors and Supervisors with information required for the implementation of business operations, assisting Directors and Supervisors to comply with laws and regulations, preparing meeting-related matters and meeting minutes for the Board of Directors meeting, shareholders’ meeting and so forth in accordance with the laws and regulations)? | V | To protect the rights and interests of shareholders and strengthen the powers of the Board of Directors, the Company appointed Huang, I-Tzu, Head of Finance and Accounting Center, as the corporate governance officer of the Company on October 28, 2022, to be responsible for the supervision and planning of corporate governance, and her qualifications meet the requirements of Paragraph 1, Article 3-1 of the Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies. | No significant differences. | |||

| The scope of duties of the Corporate Governance Officer includes: | ||||||

| 1. Handling matters related to Board of Directors and shareholders' meetings in accordance with the law. | ||||||

| 2. Preparing minutes of Board of Directors and shareholders' meetings. | ||||||

| 3. Assisting directors in their appointment and continuing education. | ||||||

| 4. Providing directors with necessary information for their duties. | ||||||

| 5. Assisting directors in complying with laws and regulations. | ||||||

| 6. Reporting to the Board of Directors on the results of reviewing the qualifications of independent directors under relevant laws and regulations during their nomination, election, and tenure. | ||||||

| 7. Handling matters related to changes in directors. | ||||||

| 8. Other matters stipulated in the Articles of Incorporation or contracts. | ||||||

| The Corporate Governance Officer reports to the Board of Directors annually on the Company's corporate governance operations. The following is a summary of the officer's performance: | ||||||

| 1. Four board meetings were held in 2024. Board meeting agendas shall be prepared and sent to directors seven days in advance. The meeting shall be convened and the meeting materials shall be provided. If the meeting agenda requires recusal, directors shall be reminded in advance. The Board of Directors resolution shall be reviewed to determine whether it requires material information disclosure, and board meeting minutes shall be completed within 20 days after each meeting. One annual shareholders' meeting was held in 2024. The officer assisted with the legal compliance of shareholder meeting procedures and resolutions. |

||||||

| 2. Assisted directors with continuing education arrangements. All board members completed at least 6 hours of continuing education courses in 2024. | ||||||

| 3. Process the pre-registration before the shareholders’ meeting date and prepare the meeting notice, handbook and meeting minutes within the statutory deadline, and process the change registration affairs after the amendments of the Articles of Incorporation and the re-election of directors. | ||||||

| 4. Promote the corporate governance index goals, and review the key items for scoring in the corporate governance evaluation index for each term. | ||||||

| 5. Regularly arranged for communication between independent directors and CPAs regarding the Company's financial position and business condition. Please refer to pages 47~48 of this annual report and the Company's website: https://www.sti.com.tw/. | ||||||

| 6. Handled directors' and key officers' liability insurance matters and reported to the Board of Directors after renewal. | ||||||

| 7. Reported the results of reviewing the qualifications of independent directors during their nomination, election, and tenure to the Board of Directors annually. | ||||||

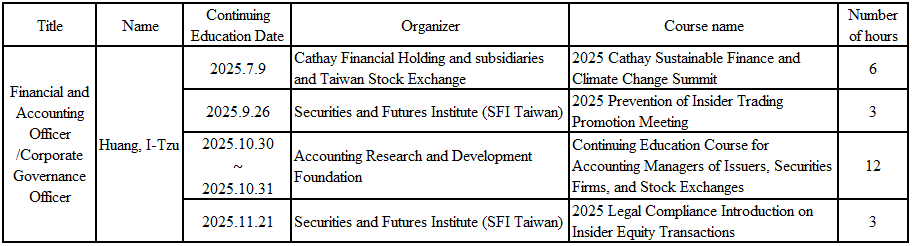

| 8. Please refer to page 60 of this annual report for information on the Corporate Governance Officer's continuing education. | ||||||

| V. Has the company established channels for communications with the stakeholders (including but not limited to shareholders, employees, customers, and suppliers), and set up a section for stakeholders on the official website of the company with proper response to the concerns of the stakeholders on issues related to corporate social responsibility? | V | The Company has appointed the spokesperson and acting spokesperson. Related contact information as well as the finance and stock affairs related information have been announced on the MOPS and posted on the company website according to the regulations. This helps to build a good communication channel with the investors. | No significant differences. | |||

| The Company values communication with stakeholders and has established effective communication channels on its external official website and internal employee portal (EIP), with dedicated personnel responsible for responding and improving the operations. | ||||||

| To enhance employee satisfaction and improve work efficiency and retention rates, the Company conducts annual employee satisfaction surveys. The Company makes improvements through relevant departments based on the survey results, reports the improvement status to the Sustainable Development Committee, and discloses the information on the Company's official website. | ||||||

| VI. Has the company contracted a professional stock affairs agency to handle the shareholders’ meeting related affairs? | V | The Company has appointed a professional stock "affairs agency The Stock Affairs Department of Yuanta Securities Co., Ltd." to handle various stock matters of the Company and has established the "Regulations Governing the Management of the Stock Affairs Process". | No significant differences. | |||

| VII. Information Disclosure | ||||||

| (I) Does the Company create a website to disclose information regarding its finance, business operations and corporate governance? | V | (I) The Company has made announcement and filed its financial business and corporate governance matters on the MOPS and company website simultaneously according to the laws. | No significant differences. | |||

| (II) Does the Company adopt other methodology of information disclosure (such as creating an English website, appointing a dedicated person to be responsible for the collection and disclosure of the Company’s information, implementing the spokesperson system, and uploading videos of the investor conferences on the company’s website)? | V | (II) The Company has created an English language website and has appointed dedicated personnel to be responsible for the collection and releasing of various company information. Information relating to the spokesperson system has also been appointed accordingly. | No significant differences. | |||

| (III) Does the Company announce and declare the annual financial statements within two months after the end of the fiscal year and announce and declare the financial reports of the first, second and third quarters as well as the monthly operating report before the deadline? | V | (III) The Company has announced and declared the annual financial statements within two months after the end of the fiscal year and announced and declared the financial reports of the first, second and third quarter as well as the monthly operating report before the deadline. The Company also discloses the financial report in English within two months after the quarterly financial report filing deadline | No significant differences. | |||

| VIII. Does the Company have other important information that can help in gaining a better understanding about the operations of corporate governance (including but not limited to the employees’ rights, employee care, investor relations, supplier relation, rights of interested parties, training status of directors and supervisors, implementation status of risk management policies and standards of risk measurement, the implementation of customer policies, the purchase of liability insurance for directors and supervisors by the Company)? | V | The Company and subsidiaries value the opinions of its stakeholders, such as, shareholders, employees, customers, and suppliers. We have created a comprehensive two-way communication platform, such as, hotlines, emails, opinion mailboxes. Each year, we will publish the corporate sustainability report, disclose the economic, environment and social aspects information on the MOPS and the Company’s website under the section on Corporate Sustainable Development and Stakeholders’ Section (Website: http://www.sti.com.tw). | No significant differences. | |||

| I. Employee rights and care for employees: Please refer to page 165 of this annual report. | ||||||

| II. Investor relation To establish a strong governance system and sound supervisory capabilities for the Company's Shareholders’ Meetings, and to strengthen management capabilities, these Rules are adopted pursuant to Article 5 of the Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies. The Rules for Shareholders’ Meeting is also established accordingly. |

||||||

| III. Supplier relation The Company requests its suppliers with dealings to sign the "Integrity Commitment” mandatorily. |

||||||

| IV. Rights of stakeholders The Company has already established the Codes of Ethical Conduct to guide the Company’s directors, supervisors and managerial officers to meet the ethical standard and to enable the stakeholders of the Company to better understand our ethical standard. |

||||||

| V. State of the directors’ continuing education The Company is eager in encouraging its directors to participate in the continuing education. Please refer to page 59~60 of this annual report for information on their continuing education. |

||||||

| VI. State of the managerial officers’ continuing education Please refer to page 60 of this annual report for information on their continuing education. |

||||||

| VII. The state of purchasing the liability insurance for directors and managerial officers by the Company The Company’s Articles of Incorporation stipulated that the liability insurance must be purchased for the directors and managerial officers. The scope of the insurance is to be reported to the Board meeting and filed on the MOPS. |

||||||

| IX. Please discuss the improvements made based on the latest annual corporate governance evaluation results released by the Taiwan Stock Exchange Corporation's Corporate Governance Center, as well as the priority enhancement items and measures for aspects not yet improved: The prepared Sustainability Report in 2024 was submitted to the Board for approval. In the future, the Company will increase the number of female directors. | ||||||